Let's start with the obvious question. We'll look into the definition of RSI Divergence actually is and what insights traders can derive from it. When the price action and RSI indicators aren't in sync, a Divergence is evident on the chart. The RSI indicator could make lower lows during downtrends, while the price action can make lower lows. In essence, a divergence occurs is when the indicator does not agree with the price action and when a situation similar to this occurs, you need to pay attention to the market. The chart shows that both the bullish RSI diversgence and bearish RSI diversion are evident. In fact, the price action reversed after the two RSI Divergence signals. Let's move on to the fun topic. See the best forex backtest software for site recommendations including crypto trading, backtesting, trading platform crypto, online trading platform, forex tester, automated trading bot, backtester, trading platform crypto, divergence trading forex, backtesting tool and more.

How Can You Determine Rsi Divergence?

We use RSI to determine trends that are reversing. Therefore, it is vital to determine the correct one.

How Can You Tell If There Is Rsi Divergence When Trading Forex

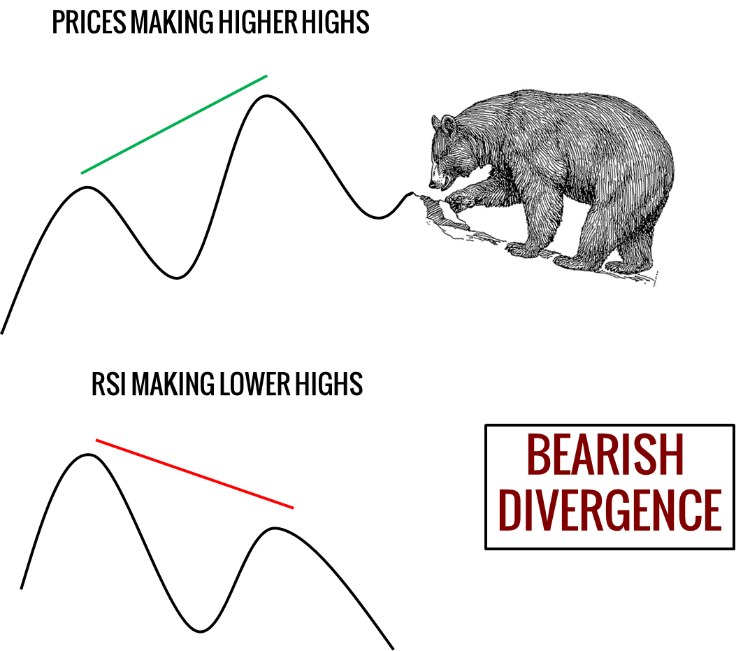

In the beginning of the trend at the beginning of the uptrend, both RSI indicator and Price Action performed the same similar thing, forming higher highs. This signifies that the trend is strong. But at the trend's arc, the price made higher highs, while the RSI indicator made lower highs. This is a sign that something needs to be observed on this chart. Here we should be paying close attention to the markets as both the indicator's actions and price are outof of sync. This indicates that there is an RSI divigence. In this case, the RSI Divergence suggests a trend that is a bearish. Check out the graph above and note what transpired following the RSI divergence. It is evident that the RSI divergence is very accurate in identifying trend reverses. The question is: what is the best way to detect the trend reversal, right? Let's take a look at four strategies for trading that mix RSI divergence with higher probability signals. Follow the top rsi divergence cheat sheet for site recommendations including bot for crypto trading, automated trading, trading divergences, automated trading platform, forex backtesting software, crypto backtesting, trading platform crypto, trading platform cryptocurrency, automated crypto trading, divergence trading forex and more.

Tip #1 – Combining RSI Divergence and the Triangle Pattern

Triangle chart patterns is used in two different ways. One variation is the Ascending Triangle pattern. It is a good choice as a reversal pattern in the downtrend. The other is the descending triangular pattern, which is used in uptrend markets as an opportunity to reverse. Let's look closer at the forex chart to observe the descending circle pattern. Just like the previous example it was in an uptrend and eventually the price start to decrease. RSI can also indicate divergence. These signals reveal the flaws in this trend. Now , we can see that the uptrend that is currently in place is losing momentum and consequently, the price eventually formed a descending triangle pattern. This confirms that the opposite is true. Now it's time for the short trade. Like the previous trade we employed the same techniques to break out for this trade , too. Let's now look at the third entry strategy to trade. This time we'll pair trend structure with RSI diversion. Let's see how to trade RSI divergence in the event that the trend structure is changing. Check out the best forex backtesting software free for website tips including automated forex trading, automated trading, RSI divergence cheat sheet, forex backtesting, RSI divergence cheat sheet, trading platforms, backtesting strategies, backtesting tool, trading platform crypto, automated crypto trading and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence is an instrument forex traders employ to detect market reversals. You can increase the likelihood of your trade by combining RSI diversence with other potential reversal factors like the Head and Shoulders pattern. Let's explore how to make the right timing trades with RSI divergence and the head-shoulders pattern. Related - Trading Head and Shoulders Patterns in Forex: A Reversal Trading Strategy. Before committing to trades it is essential that you have an appropriate market. The markets that are trending are the best since we're trying to find the possibility of a trend reversal. Check out this chart. Check out the top crypto trading backtester for blog tips including cryptocurrency trading, stop loss, trading divergences, backtesting tool, software for automated trading, trading platform cryptocurrency, backtester, forex tester, automated trading software, automated trading and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

The trend is our friend. If the market is in a trend, then we should be trading in the direction of that trend. This is what professionals instruct us. The trend will eventually end but it won't last for ever. Let's look at how we can detect reversals using the structure of trends and RSI Divergence. You've probably noticed that the trend upward is creating higher highs while downtrend is forming lower bottoms. Let's take a glance at the chart. The chart's left side shows a downtrend, with a series a lows and highs. The next step is to have a closer look at the RSI Divergence (Red Line). The RSI creates high lows. Price action creates lows. What is this indicating? Even though the market is creating low RSI which means that the ongoing downtrend in momentum is losing its momentum. Have a look at the top automated forex trading for site info including trading platform crypto, crypto trading backtesting, best trading platform, online trading platform, backtester, backtester, trading platform, forex backtesting software, automated trading platform, automated trading and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom, And Double Bottom

A double top, or double bottom, is a reverse trend that occurs after an extended move. Double top is formed when the price has reached a level which is impossible to break. Once it has reached that point, the price will retrace down a bit, only to return back to the same level again. If the price bounce from the level once more, then you've got an OVER-OP. Have a look at the double top. The double top that you see above shows two tops that were created by a powerful move. The second top was not able to over the first. This is a clear indication that a reversal could occur because it tells the buyers that they're struggling to go higher. Double bottoms also employ the same concepts, but it is performed in an opposite direction. In this case, we apply the technique of breakout entry. This means that we will sell the trade once the trigger line crosses beneath the price. The price made our take profit within a matter of days. QUICK PROFIT. The same techniques for trading can be applied for the double bottom as well. Below is a chart which will show you the best way you can trade RSI diversgence using double top.

This isn't the ideal trading strategy. There isn't a single trading method that is perfect. Every strategy for trading has losses. We can earn consistent profits through this strategy for trading but, we do have a strict risk management system and a method to reduce our losses. It will help reduce the drawdown, which could open the door to big upside potential.