It is crucial to select the best Forex Broker, since this can impact your trading, security and overall experience. Here are 10 crucial suggestions for selecting a Forex broker.

Review the status of regulatory agencies and their reputation.

1. It is best to use brokers who are regulated by reputable agencies, like the U.S. CFTC or UK FCA. Regulation makes sure that brokers adhere to industry standards. It also protects your money and ensures fair trade practices. Avoid unregulated broker or those with complaints.

2. Examine the trading Costs (Spreads and Commissions)

Brokers earn their income through commissions or spreading (the gap between the prices of purchasing and selling). Look for brokers with affordable and transparent charges. You might find that a broker with tight spreads is more cost-effective for those who trade regularly. Beware of hidden costs, such as high withdrawal fees or inactivity fees.

3. Compare the range of currency pairs available

Make sure that the broker offers a wide choice of currency pairs including major (such as EUR/USD) or minor. A greater selection of currency pairs allows you to diversify and trade based on market opportunities.

4. Review the Trading Platform and Tools

The platform for trading is where you exchange information with the market. Therefore, it should be simple to use, reliable, and have tools that are compatible with your style of trading. A lot of brokers use platforms such as MetaTrader 4(MT4), MetaTrader 5 (5MT5) or their own software. Try out the features of the platform like charts, indicators for technical trading and speed of order execution prior to committing.

5. Examine the types of accounts and leverage options.

Brokers offer a variety of account types, which differ in regards to spreads, leverage and deposit minimums. Choose a broker that offers an account type that's suited to your budget and trading style as well as the level of experience. Avoid brokers with high levels of leverage. This can increase your risk, especially when it's your first time you trade.

Review Your Deposit and Withdrawal Options

Check the available withdrawal and deposit methods along with processing times, as well as fees associated with them. A reliable broker will provide secure, convenient and affordable methods such as transfer to banks, credit card payments, or e-wallets that are reputable, such as PayPal or Skrill. Beware of brokers that have lengthy withdrawal times or charge excessive fees.

7. Test Customer Support Responsiveness

It is crucial to be able to provide a reliable customer support, especially in the case of urgent issues such as withdrawal problems or platform malfunctions. The customer service is tested through contacting the broker using various channels. Search for brokers offering 24/7 support if your trading occurs outside of normal business hours.

8. Security Measures to Protect Funds

Your funds should be secure with a reputable broker. Find out if the broker has client funds in segregated accounts (separate from the broker's operating funds) and offers negative balance protection that prevents you from losing more than your balance. These safeguards protect your money should the broker go bankrupt or if market volatility occurs.

9. Find educational Resources and Support for Beginners

These resources include webinars, trading guides, market analysis and a demo account. These tools are extremely beneficial, especially if it is your first experience you've ever traded Forex or you're trying to increase your proficiency. Demo accounts allow you to try out your skills without risking any real money, and are the opportunity to gain experience in a safe manner.

10. Read Independent Reviews or Ask for recommendations

Reviews from other traders can provide insight into the strengths and weaknesses of a broker, such as hidden fees, withdrawal problems or issues with the platform. There are reviews available on trustworthy forums for trading as well as review websites and communities. Beware of fake reviews and blatantly advertising remarks. You can also count on the recommendations of seasoned traders to help you.

Choosing the right Forex broker is a careful evaluation of several elements. To determine which broker best meets your needs in trading it is important to consider transparency, regulatory compliance, as well as the general conditions of trading. Have a look at the recommended https://th.roboforex.com/ for site info including recommended brokers forex, currency trading demo account, forex market online, forex trading strategies, forex best trading app, forex trading demo account, forex trading demo account, best currency brokers, foreign exchange trading platform, forex trading brokers and more.

Top 10 Technical And Fundamental Analysis Tips For Trading Forex Online

In Forex trading both fundamental and technical analyses are important. You will be able to make informed and strategically sound decisions when you are able to master both. Here are 10 top tips on how to use technical and fundamental analyses in trading online Forex trading.

1. Find out the main levels of resistance and support.

Support and Resistance levels are price zones that often cause currency pairs to pause or reverse. These levels function as psychological barriers crucial when planning your exit and entry. It is essential to practice identifying these zones to better understand how the market will change direction or even begin to break out.

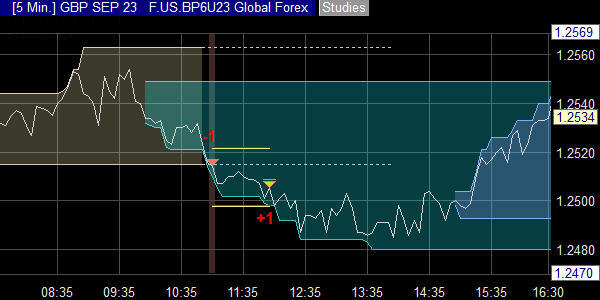

2. Multi-timeframes give you more perspective

Analyzing charts that have different timeframes, such as daily, 4-hour and 1-hour gives insight into the bigger picture as well as the short-term trends. Lower timeframes give a better understanding of the trends.

3. Master Key Technical Indicators

Moving averages, Relative Strength Index and Moving Average Convergence Divergence are some of the most crucial indicators in Forex trading. Learn the functions of each indicator and learn how to integrate them for improved accuracy.

4. Candlestick patterns can be an excellent indication of patterns on candlesticks.

Candlestick patterns, such as dojis, hammers and Engulfings, could be a sign of a possible continuation or reverse. Be able to spot these patterns and to identify the possibility of price fluctuations. Combining candlesticks analysis with other tools, such as support/resistance and resistance/support, can help you to improve your timing.

5. Use Trend Analysis to Find Clues to the Direction.

Moving-averages and trendlines can be used to determine markets in uptrends, sideways or downtrends. Following the trend is a common strategy in Forex trading as following the trends usually provides more consistent outcomes. If you're not an expert, you should avoid making trades against the current trend.

Fundamental Analysis Tips

6. Learn about Central Bank policies and interest Rates

Central banks, such as the Federal Reserve Bank and the European Central Bank are in charge of interest rates. These rates directly impact currency values. A higher rate of interest tends to strengthen currencies, while lower rates may reduce its strength. Pay attention to central bank statements, which can cause market fluctuations.

7. Follow Economic Indicators Reports

Important economic indicators like GDP (gross domestic product) as well as unemployment rates, inflation and consumer confidence, can give you an idea of the state of health of a specific country, and impact its currency value. You can utilize an economic calendar to stay up with upcoming announcements and find out how they affect the currency pairs you trade.

8. Geopolitical Events and News: Examine them

Events in the political world, like trade negotiations, elections or conflicts, may affect market prices for currencies. Keep up-to-date with news from around the world particularly about the major economies including the U.S.A, Eurozone, China. The turbulence in geopolitics can be triggered by sudden changes in geopolitical power.

Combining technical and fundamental analysis

9. The alignment of technical signals to fundamental Events

Combining fundamental and technical analysis improves decision-making. If you have the expectation of a positive economic report and a technical setup that indicates a strong upward trend, the two can be paired to create a stronger buying signal. By integrating both approaches it will reduce the uncertainties and increase the chance of the success.

10. Use Risk Events as Trading Opportunities

These highly volatile, high-impact events can cause price fluctuations. Many traders steer clear of this time because of the uncertainty. However, if you are experienced and have a good understanding of the power of technical analysis to make the most of price swings. You must be cautious and set up tight stop-loss stops.

When it comes to Forex trading, the integration of fundamental and technical analysis can provide a thorough understanding of market trends. Through mastering these techniques traders will be able to navigate the foreign exchange markets more efficiently, take better strategic decisions and improve their overall performance. Have a look at the best https://th.roboforex.com/clients/funds/deposit-withdrawal/ for website recommendations including forex trading strategies, best forex trading broker, currency trading demo account, app forex trading, forex trading brokers, forex trading forex, best forex trading broker, forex best trading app, fx forex trading, top forex trading apps and more.

Top 10 Financial And Personal Goals Tips When Considering Trading In Forex Online

Forex trading is only profitable if you have clearly defined goals for your personal and financial life. With clear objectives, you can keep your trading focussed and focused while aligning it with your financial goals. Here are 10 top tips for managing your personal and financial goals when you trade online Forex.

1. Define Your Financial Objectives Clearly

Make specific financial goals, such an income target or annual return goal. Select whether your objectives are for capital growth or an additional source of income. Being clear about your goals will help you choose strategies that are compatible with the results you desire.

2. Create a Realistic Timeframe

It can take time to master the art of trading. Set both short-term and medium-term objectives to keep track of your progress and avoid the stress of unrealistic expectations. Your short-term goals could include creating a profitable trading strategy and your long-term goals might include achieving steady monthly gains.

3. Determine Your Risk Tolerance

Check your comfort level with the risk. Be sure that your objectives and level of comfort match. If you want high returns, for example be prepared for greater risks and volatility. Understanding your risk tolerance will help you set goals and choose strategies that don't go over your comfortable level.

4. Plan a Capital Allocation Strategy

Choose the amount you're willing and able to spend on Forex trading. You should only invest only a small portion of your total finances in Forex trading. Then, you can ensure that your trading won't affect the funds you need for expenses, savings or other personal obligations.

5. The goal is to improve the skills

Set a goal to continuously enhance your knowledge and abilities, instead of focusing on the financial gain. Examples of developing your skills goals include mastering a specific trading strategy, improving your risk management, or learning how to manage your emotions under stress. Skills improve over time and produce more effective results.

6. Prioritize Consistency Over Large Wins

Many novice traders aim to make huge gains quickly, however skilled traders understand that regular growth that is steady and consistent are more reliable. Set a monthly goal of achieving an achievable percent increase. Consistent returns can help you avoid high risk actions and establish a reliable track record.

7. Make a commitment to track your progress regularly and reviewing your own performance

Make it a point to maintain a trading log in which you document every trade, review the results and reflect on the lessons you have learned. Reviewing your performance every month or every quarter your performance can help refine your strategy, remain accountable to your goals and adapt your strategy.

8. Set behavioral and psychological goals

Trading requires emotional and mental control. Establish goals that are based on the psychological aspects such as minimizing impulsive trading, adhering to your plan, or lessening the need to trade revenge. These goals will assist you develop an enlightened and disciplined approach.

9. Avoid comparison with others

Forex trading is a personal journey, and comparing your results with other traders' outcomes can lead you to make risky or unnecessary choices. Make your goals based on your personal progress and financial capability, not the results of other traders. Focus on improving gradually rather than trying to outperform other traders.

10. Define an Exit Strategy or Financial Milestone

You might want to set a goal for yourself which will allow you to halt trading, or withdraw your profits, or evaluate the overall performance. If you hit a certain amount of profit, you may take some of your gains and invest them or simply enjoy them. It is essential to determine a point at which you end your trading and be grateful for the gains.

Setting and managing clearly defined personal and financial Forex trading goals can help enhance your discipline. This will lessen anxiety and help you achieve lasting success. Always adjust your goals to match your progress, and focus on a consistent approach as well as personal accountability and constant improvements. Check out the best https://th.roboforex.com/beginners/info/national-holidays/ for site tips including forex market online, forex exchange platform, top forex trading apps, currency trading demo account, fx trading platform, best forex broker trading platform, fbs broker review, foreign exchange trading online, best forex broker trading platform, forex trading forex trading and more.